Continued growth and improved operating margin as 2024-2026 strategy implementation commenced

SECOND QUARTER RESULTS

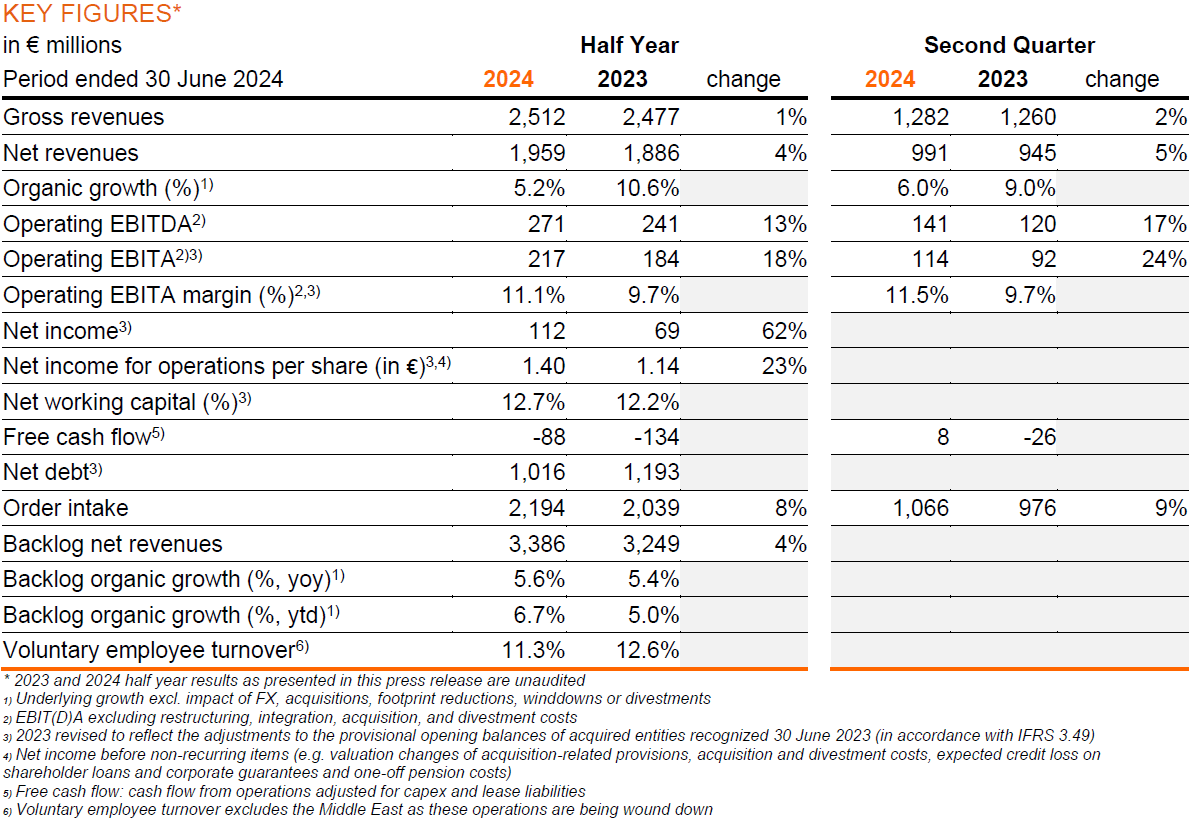

- Net revenue of €991 million, solid organic growth of 6.0%1)

- Strong order intake of €1.1B resulting in organic backlog growth of 5.6% year-on-year

- Improved operating EBITA margin2) to 11.5% (Q2’23: 9.7%3)) driven by operating leverage and improved project portfolio

- Free cash flow of €8 million (Q2‘23: €-26M), net working capital % of 12.7% (Q2‘23: 12.2%3))

Amsterdam, 25 July 2024 – Arcadis, the world’s leading company delivering data-driven sustainable design, engineering, and consultancy solutions for natural and built assets, sees continued growing client demand across all its business, resulting in net revenue of €991 million, organic growth of 6% and an improved operating EBITA margin of 11.5% (Q2‘23: 9.7%3)).

Alan Brookes, CEO Arcadis, said: “Arcadis has delivered a strong first half year of its strategy cycle 2024-2026. Sustained client demand across all our Global Business Areas and specifically in solutions across Energy Transition, Water, Technology and Mobility resulted in strong revenue growth and order intake in the quarter. Operating leverage, an improved project portfolio and cost control allowed us to further improve our margin and deleverage our balance sheet. Meanwhile, we achieved the first milestones in our strategy implementation through the roll out of our Skills Powered Organization, the advancing of the Arcadis Energy Transition Academy and expansion of the Global Excellence Centers. Our deep asset knowledge, global expertise and complementary set of services are key success factors allowing us to further drive continued profitable growth and to better serve our clients.”

REVIEW OF THE SECOND QUARTER 2024: PROFIT & LOSS ITEMS AND BACKLOG

Net revenues totaled €991 million, increasing by 6.0% organically, driven by all Global Business Areas (GBAs). Revenue and backlog growth was particularly strong in US and Europe with demand for our solutions across Energy Transition, Water, Technology and Mobility accelerating. The improved operating EBITA margin of 11.5% was driven by operating leverage, an improved portfolio and the materialization of cost synergies following a successful integration of IBI and DPS. Furthermore, we expanded our Global Excellence Centers workforce by 21% year-on-year to over 4,700 people, continued to invest in our key talent with the launch of our Skills Powered Organization, advancing of the Arcadis Energy Transition Academy.

REVIEW OF THE HALF YEAR 2024: PROFIT & LOSS ITEMS AND BACKLOG

Net revenues totaled €1,959 million, increasing organically by 5.2% driven by all GBAs. The operating EBITA margin increased to 11.1% (H1‘23: 9.7%3)). Non-operating costs were €14 million, driven by portfolio optimizations such as the ongoing wind-down of the Middle East operations, merging of offices and other restructuring activities. Net finance expenses were €23 million (H1‘23: €28 million). Net income from operations increased by 23% to €126 million (H1‘23: €102 million3)), or €1.40 per share (H1‘23: €1.143)). Order intake increased by 8% year-on-year to a record level of €2,194 million, outperforming total revenue growth of 4% and resulting in a book-to-bill of 1.12x. We see a significant pipeline of opportunities driven by allocation of stimulus funding across Arcadis’ key markets. Excluding the Middle East, the operating EBITA margin performance was 11.1% in the first half of 2024.

Solid demand across our Resilience solutions led to strong results in our key markets, including the US, the UK, the Netherlands and Germany. We continued to see significant growth in our Energy Transition solutions and relating advisory services. Our leading position in the Water sector resulted in significant project wins, underscoring our skills and ability to deliver high-value projects. Furthermore, we became more selective in our bidding processes, which resulted in increased discipline around order intake and was yet reflected in our margin performance. We continued to make investments in industry leading talent, including through our Arcadis Energy Transition Academy.

1) Underlying growth excl. impact of FX, acquisitions, footprint reductions, winddowns or divestments

2) EBITA excluding restructuring, integration, acquisition and divestment costs

3) Revised to reflect the adjustments to the provisional opening balances of acquired entities recognized 30 June 2023 (in accordance with IFRS 3.49)

Places showed good revenue growth driven by Germany, the UK, Ireland, the Netherlands and Canada. Demand for datacenters design remained strong, while our semiconductor clients’ demand picked up on the back of CHIPS Act funding. We see good opportunities in our project pipeline as stimulus fund allocations across our solutions portfolio are beginning to come through.

Mobility showed continued strong revenue growth in our key markets Australia, North America and Europe. Our global expertise resulted in significant multi-year project wins in H1’24, which are to contribute to order intake in the second half of 2024 and to our business performance in 2025 and beyond. Margin improvement resulted from double-digit US growth generating operating leverage, and improved performance with large government clients in the UK.

1) EBITA excluding restructuring, integration, acquisition and divestment costs

2) Underlying growth excl. impact of FX, acquisitions, footprint reductions, winddowns or divestments

3) Revised to reflect the adjustments to the provisional opening balances of acquired entities recognized 30 June 2023 (in accordance with IFRS 3.49)

Intelligence saw good growth in North America and UK, particularly driven by improved Enterprise Decision Analytics (EDA) sales. In addition, Intelligence was instrumental in generating significant synergy wins for large Key Clients, which were mostly recorded with Mobility and Places, as we continue to focus on leveraging our digital tools and our existing Key Client relationships. Meanwhile, we accelerated our digital strategy by making key hires and driving our digital product roadmap.

BALANCE SHEET & CASH FLOW

Days Sales Outstanding (DSO) was 66 days at the end of H1’24 (H1‘23: 65 days3)). Net Working Capital as a percentage of annualized quarterly gross revenues was 12.7% (H1‘23: 12.2%3)), with a strong June performance driving up the receivables position. Free cash flow in the quarter was a positive €8 million resulting in €-88 million for the half year (H1‘23: €-134 million), in line with seasonal trends and including the first interest payment of €24 million on our Eurobond issued February 2023. Net debt decreased to €1,016 million (H1‘23: €1,193 million3)) leading to a Net Debt / Operating EBITDA ratio of 1.9x (H1‘23: 2.4x).

COST SYNERGIES REALIZATION ON TRACK

Following the finalization of the successful integration of Arcadis IBI and Arcadis DPS which was finalized by the end of 2023, the cost synergy realization is well on track with €20 million to be implemented by the end of 2024, mostly through further rationalization of workplaces and optimization of overheads, insurance & support.

2024-2026 STRATEGY “ACCELERATING A PLANET POSITIVE FUTURE”

On 16 November 2023 Arcadis presented its 2024-2026 Strategy “Accelerating a planet positive future” and its 2026 financial targets; these include: organic net revenue growth of mid to high single digits over the cycle, operating EBITA margin of 12.5% in 2026, Net Debt / Operating EBITDA of 1.5-2.5x with an Investment Grade credit rating and a dividend payout ratio of 30-40% of Net Income from Operations.

1)EBITA excluding restructuring, integration, acquisition and divestment costs

2)Underlying growth excl. impact of FX, acquisitions, footprint reductions, winddowns or divestments

3) Revised to reflect the adjustments to the provisional opening balances of acquired entities recognized 30 June 2023 (in accordance with IFRS 3.49)

FINANCIAL CALENDAR

- 31 October 2024–Q3 2024 Trading Update

- 13 February 2025–Q4 & Full Year 2024 Results

- 7 May 2025–Q1 2025 Trading Update

All IR investor events click here.

ARCADIS INVESTOR RELATIONS

Christine Disch | +31 (0)615376020 | christine.disch@arcadis.com

ANALYST WEBCAST

Today at 14:00 CEST, click here.